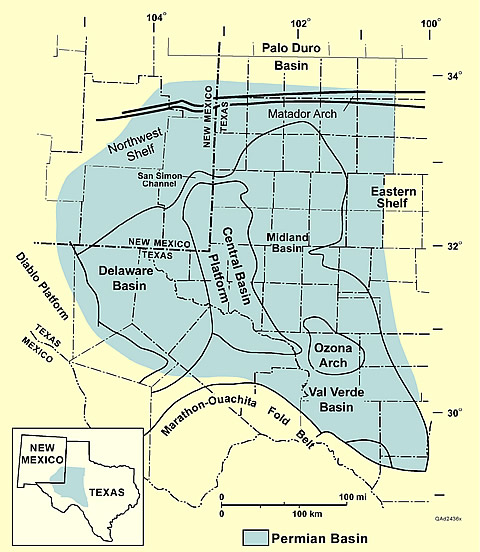

Economists at IHS Markit recently issued a report (summarized here) that predicts that oil production in the Permian Basin will almost double by 2023, increasing by 3 million barrels per day (mbd) to 5.4 mbd. That level of growth will account for more than 60% of net global oil production. As Daniel Yergin, vice-chairman of IHS Markit indicates, “(i)n the past 24 months, production from just this one region—the Permian—has grown far more than any other entire country in the world. Add an additional 3 mbd by 2023—more than the total present-day production of Kuwait—and you have a level of production that exceeds the current production of every OPEC nation except for Saudi Arabia.”

In a separate report, summarized here, IHS Markit predicts that natural gas production will rise in the United States by almost 8 billion cubic feet per day (bcf/d) or more than 10 percent in 2018 alone. Altogether, U.S. production is expected to grow by another 60 percent over the next 20 years, the report says. In the Permian Basin alone, production of both natural gas and natural gas liquids (NGLs) are expected to double from 2018 to 2023, reaching 15 bcf/d and 1.7 mbd, respectively.

In terms of the economic security of the U.S., this is a good thing. Having enough domestic production to meet our needs means we don’t have to dance to the tune that OPEC plays. In addition, increased production of natural gas means more gas available to cleanly produce electricity. However, there are unintended consequences. IHS Markit predicts that the major players in the Permian Basin, ExxonMobil, Royal Dutch Shell and Chevron, will have to invest nearly $30 billion in capital investment to achieve their current growth targets. On the negative side, that means that the smaller, independent, oil companies are going to get squeezed out or will be acquired by larger companies. Greater market share by fewer and larger companies could translate into economies of scale that could lower the price of oil and gas, but could also result in higher prices if there are markups due to vertical integration. In addition, the capital investment by these larger oil companies will probable inflate the cost of oil field goods and services. Higher prices for oil field goods and services can mean higher prices for oil and gas products for consumers. On the positive side, higher prices for oil field goods and services and higher oil and gas production means more people are employed in the industry and are getting higher wages. Higher prices for oil and gas production also means oil and gas companies are paying more in property taxes to local governments. Higher prices for oil and gas means oil and gas companies can pay higher dividends to their shareholders and more royalties to mineral owners, some of whom are retired folks who depend on dividend and royalties to live.

Time will tell whether the increased production of oil and gas will result in net good for the country. As you can see, there are a lot of factors that go into this, and it is not something that is easy to predict.

Texas Oil and Gas Attorney Blog

Texas Oil and Gas Attorney Blog