In a significant win for reasonable and sensible energy regulation, the DC Circuit Court rejected the Environmental Protection Agency’s (EPA) 2012 cellulosic biofuels projection. It is sad that this is what passes as a “win” for the energy industry however, since the Court simply acknowledged that the EPA’s requirements are based on fiction and require supplies of materials that are not even available currently!

The case being decided involved a challenge by the American Petroleum Institute (API) to the EPA’s regulation. The regulation in question was adopted under the renewable fuel standard program, which requires refiners to blend 36 billion gallons of biofuel with traditional fossil fuels by 2022. That goal has incremental targets leading up to it, and by 2012 refiners were required to blend 10.45 million biofuel ethanol gallons with their gasoline– an impossibility considering that the entire industry only produced 22,000 gallons of biofuel last year. API argued that these rules forced refiners to buy “credits” for the cellulosic biofuel since this product does not not, and may never, get produced in sufficient quantities to comply with the EPA regulations. API fairly asserted that the EPA should base the biofuel requirement on a realistic assessment of current production levels.

The decision, written by Judge Stephen Williams, stated, “We agree with API that because EPA’s methodology for making its cellulosic biofuel projection did not take neutral aim at accuracy, it was an unreasonable exercise of agency discretion.”

Texas Oil and Gas Attorney Blog

Texas Oil and Gas Attorney Blog

The Eagle Ford has already shown impressive growth, going from 100,000 barrels per day of liquids such as natural gas in early 2011, to 700,000 barrels per day by December 2012. This dramatic increase is, according to WoodMac, due to technology and expertise. A lot of the money spent in the Eagle Ford this year will come from three major operators:

The Eagle Ford has already shown impressive growth, going from 100,000 barrels per day of liquids such as natural gas in early 2011, to 700,000 barrels per day by December 2012. This dramatic increase is, according to WoodMac, due to technology and expertise. A lot of the money spent in the Eagle Ford this year will come from three major operators:  The new report was written by the Chamber’s

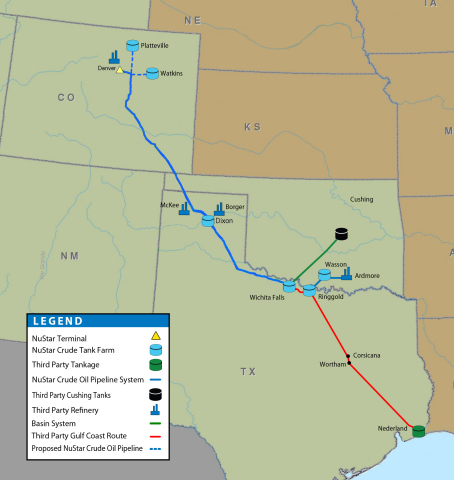

The new report was written by the Chamber’s  To find out what kind of interest exists for this new pipeline project, NuStar held a

To find out what kind of interest exists for this new pipeline project, NuStar held a  Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.

Of those surveyed, 75% think the US is already self sufficient in natural gas or will be within ten years.